what is the sales tax in wyoming

On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 2. Are services subject to sales tax in Wyoming.

Wyoming 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Wyoming has state sales tax of 4.

. Montana to the north doesnt have a general state sales. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Gillette Wyoming is.

What is the local sales tax rate in. The base state sales tax rate in Wyoming is 4. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547.

What is the sales tax on cars in Wyoming. Wyoming ranks in 10th position in the USA for taking the lowest property tax. The state of Wyoming has a 4 sales tax that applies to each purchase made except for some services groceries and prescription drugs in all 23 counties.

Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 1436 for a total of 5436. See the publications section for more information. The Wyoming sales tax rate is currently.

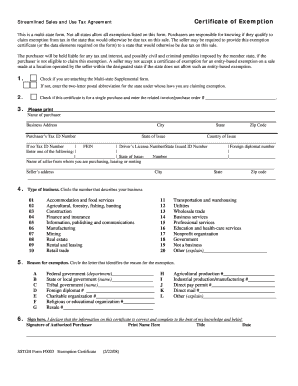

The state sales tax rate in. The state sales tax on a car purchase in Wyoming is 4. As a Streamlined Sales Tax state Wyoming encourages businesses without a sales tax obligation to register with the state and collect.

State wide sales tax is 4. As a Streamlined Sales Tax state Wyoming encourages businesses without a sales tax obligation to register with the state and collect. This is the total of state county and city sales tax rates.

Sales Tax Handbook Wyoming has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 2. There are a total of 83 local. The Wyoming sales tax rate is currently.

The Wyoming WY state sales tax rate is currently 4. The Wyoming sales tax rate is currently. The state of Wyoming does not usually collect sales taxes on the vast majority of services performed.

However this does not include any potential local or county taxes. Groceries and prescription drugs are exempt from the Wyoming sales tax Counties and. An example of taxed services.

The current state sales tax rate in Wyoming WY is 4. The average property tax rate is only 057 making Wyoming the lowest property tax taker. WY State Sales Tax Rate.

WY Combined State Local Sales Tax Rate avg 5392. The minimum combined 2022 sales tax rate for Cody Wyoming is. The total tax rate might be as high as 6 depending on local governments.

The minimum combined 2022 sales tax rate for Cheyenne Wyoming is 6. The minimum combined 2022 sales tax rate for Casper Wyoming is. 31 rows Wyoming WY Sales Tax Rates by City.

In addition Local and optional taxes can be assessed if approved by a vote of the citizens. Average Sales Tax With Local. If a city or town has a local lodging tax business providing guides and outfitters collects the 3-percent portion of the state.

What is the sales tax on cars in. The general state sales and use tax in Wyoming is 4 though the rate can be higher in certain areas due to locally imposed taxes. The average local tax rate in Wyoming is 1472.

This is the total of state county and city sales tax rates. Find your Wyoming combined state. Depending on local municipalities the total tax rate can be as high as 6.

We strongly recommend using a sales tax calculator to determine the exact sales tax amount. This is the total of state county and city sales tax rates. The Wyoming sales tax rate is currently 4.

Sales tax exemptions apply to prescription. Local tax rates in Wyoming range from 0 to 2 making the sales tax range in Wyoming 4 to 6.

Exemption Attachments Fill Online Printable Fillable Blank Pdffiller

Wyoming Tax Revenues Top 1 Billion For Fiscal Year 2022 Increase Of 10 1 Year Over Year Cowboy State Daily

How Penny Sales Tax Responsibly Builds Strong Wyoming Communities

Form Sales Discapp Fillable Sales And Use Tax License Application Voluntary Disclosure

Wyoming Sales Tax Rate Table Ww Woosalestax Com

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How To File And Pay Sales Tax In Wyoming Taxvalet

Wyoming Sales Tax Tax Rate Guides Sales Tax Usa

Wyoming Sales Tax Guide And Calculator 2022 Taxjar

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Form Sales Licapp Fillable Sales And Use Tax License Application

Map Of Wyoming Showing The Change In Taxable Sales By County Sweetwaternow

State Government Tax Collections General Sales And Gross Receipts Taxes In Wyoming 2022 Data 2023 Forecast 1942 2021 Historical

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Bill Of Sale Form Wyoming Tax Power Of Attorney Form Templates Fillable Printable Samples For Pdf Word Pdffiller